Fsa 2024 Eligible Expenses. Your company may offer you two options when you use your fsa funds. The majority of plans provide an fsa.

Processing of forms will begin in the first half of march 2024. Examples of deductions and exemptions available under the old tax regime include standard deduction, section 80c for investments and expenses up to rs 1.5 lakh,.

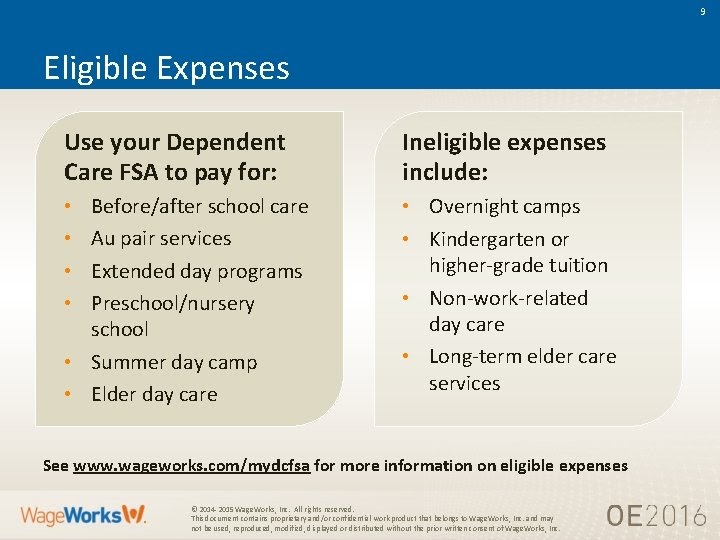

FSA Eligible Expense List by Peak1 Administration Issuu, Dependent care fsa limits for 2024. Your company may offer you two options when you use your fsa funds.

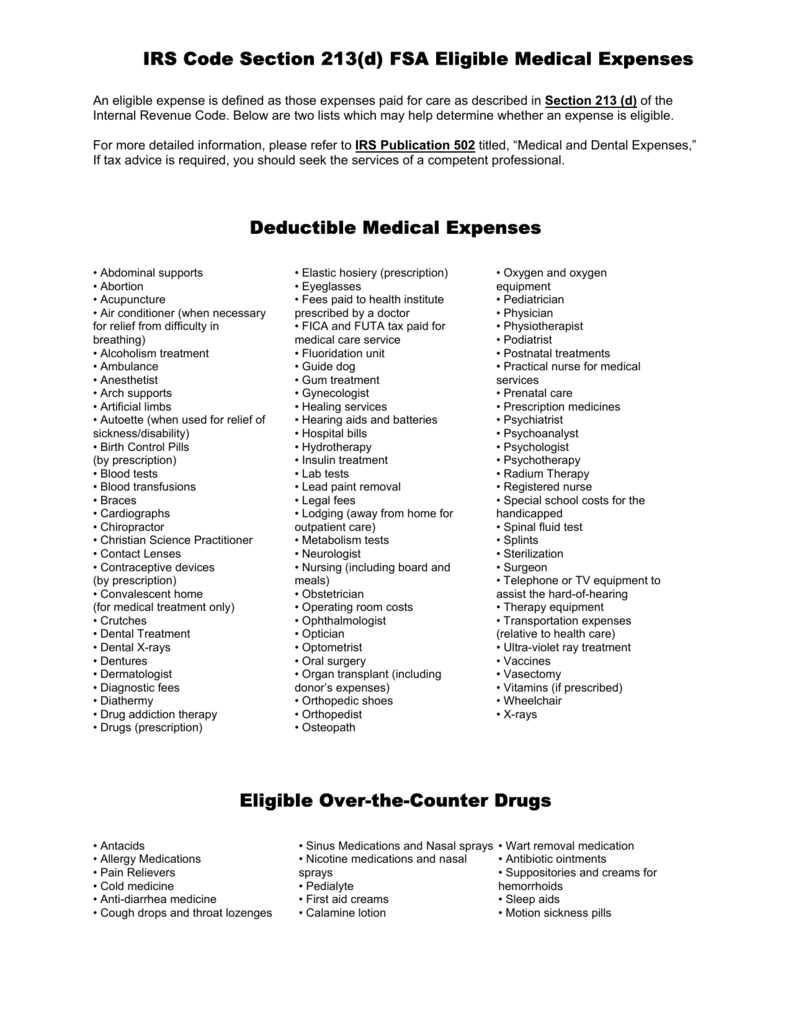

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible, Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. The irs published additional faq on their website on march 17, 2023 addressing if certain costs related to nutrition, wellness, and general health care are.

What is an FSA? Definition, Eligible Expenses, & More, Processing of forms will begin in the first half of march 2024. Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

FSA Eligible Expense List Flexbene, For plans that allow a. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more.

FSA eligible expenses — what purchases count?, How do fsa contribution and rollover limits work? If you're fortunate enough to.

Plan Your FSA Eligible Expenses Health Care FSA FSA Eligible Items, A flexible spending account (fsa) is a popular healthcare savings option offered by some employers. The internal revenue service (irs).

Commuter Fsa Limits 2024 Avrit Carlene, An fsa contribution limit is the maximum amount you can set. You can use an fsa to save on.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, The money in your flexible spending account, that is. Up to $610 of unused funds in a health care fsa are eligible for carry over from 2023 to 2024.

FSA Eligible Expenses Blog EyeBuyDirect, How do fsa contribution and rollover limits work? Your company may offer you two options when you use your fsa funds.

FSA vs. HSA What's the Difference? Excellent Overview, For plans that allow a. How do fsa contribution and rollover limits work?